Eric E. Bosch, CPA, President and CEO of LaPorte CPAs & Business Advisors (LaPorte) and Tracy Tufts, CPA, CCIFP, Director of Audit and Assurance Services,…

Gregory P. Romig, CPA, Director of Audit and Assurance Services, has been appointed to serve on the Louisiana Tax Commission, pending Senate approval. Romig will…

BackgroundIn 2021, Congress enacted the Corporate Transparency Act (CTA) which requires enhanced reporting of beneficial ownership in reporting companies. Most businesses will be subject to…

For years, employee benefit plans (EBPs) have been under a regulatory microscope. Recently, the Department of Labor (DOL) issued a report, Audit Quality Study, November…

In December, Louisiana’s Department of Natural Resources approved the state’s first offshore wind farm development projects.The two approved projects, which may begin construction as early…

Project successes are never guaranteed. Even when everything goes right during construction, your company could be subject to losses after the job closes. Fortunately, there…

Construction leaders know that project successes rely on the proper management of both the jobsite and the back-office. This article delves into improving efficiencies at…

Nikki Burmeister has joined LaPorte CPAs & Business Advisors as Chief Operating Officer, announced Eric Bosch, firm President and CEO. Nikki replaces retiring COO Patricia…

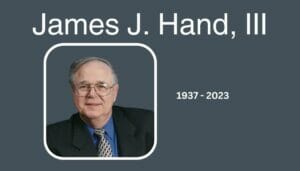

James J. “Jimmy” Hand, III, a named partner of LaPorte Sehrt Romig Hand (now LaPorte CPAs & Business Advisors) passed away peacefully on September 27,…

LaPorte CPAs & Business Advisors, the largest independent accounting and business consulting firm headquartered in Louisiana, has been named to the 2023 ‘Best Places to…