The Consolidation Appropriations Act, 2021, has extended the Employee Retention Credit (ERC) through July 1, 2021. In addition, the new regulations change which businesses can claim the credit in 2021 as well as the computational rules for those who seek to claim the credit retroactively to March of 2020. The ERC was initially passed as part of the CARES Act in March 2020 and was intended to help business owners retain their employees during the COVID-19 pandemic. The ERC could not, however, be taken if a business had received a Paycheck Protection Program (PPP) loan. Also under the CARES Act, employers were required to pay family and sick leave according to specific rules and restrictions. In 2021 there is no requirement for employers to pay employees who miss work due to COVID-19, however, the expansion of the ERC credit provides incentive for employers to pay their employees even if they are unable to work.

From a very high level and with a number of restrictions, the new law opens the ERC to employers who received PPP Loans in 2020, changed the threshold of full-time equivalent employees from fewer than 100 employees to fewer than 500, increases the cap on wages that may be claimed, and changes the defined gross receipts test needed to claim the credit. It is important to note that wages used to qualify for PPP Loan forgiveness may NOT be used to claim the ERC. It is also important to note, that the wage calculations, gross receipts tests, number of employees, and credit maximums are dependent upon the year in which the wages were paid.

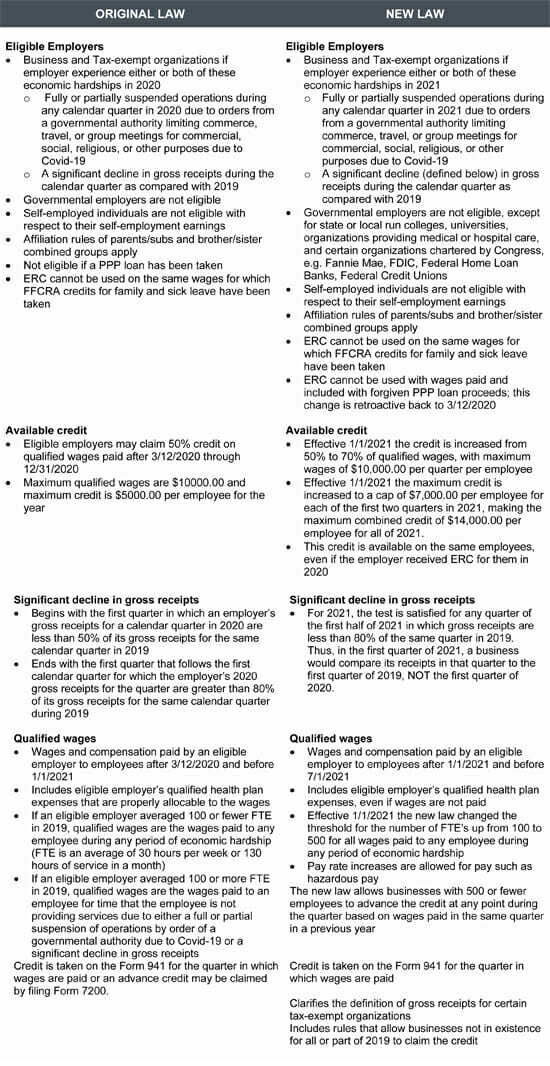

As with the CARES Act in 2020, the regulations and calculations can be complex – and can offer much needed assistance to businesses struggling due to the COVID-19 pandemic. The chart below offers a side-by-side comparison of the key differences.

As business owners look to the Consolidation Appropriations Act, 2021 for relief, it is important to understand whether they may qualify for this important credit and how to apply the calculations for 2020 and 2021 wages properly. For assistance with questions about the ERC, please contact a LaPorte tax or accounting professional.