Credits and incentives available to retirement plan sponsors

(authored by RSM US LLP) Employers with less than 100 employees who have recently adopted or are considering a retirement plan have a tax savings opportunity.

Cybersecurity perception is reality until facts intervene

(authored by RSM US LLP) To ensure cybersecurity preparedness, boards need to transform their perception of cybersecurity governance into reality.

Corporate Transparency Act: Beneficial Ownership Reporting

Background In 2021, Congress enacted the Corporate Transparency Act (CTA) which requires enhanced reporting of beneficial ownership in reporting companies. Most businesses will be subject

The IRS urges businesses to review ERC claims for 7 common red flags

(authored by RSM US LLP) IRS urges employers to review ERC claims before the Voluntary Disclosure Program deadline of March 22, 2024. The agency warns of 7 common signs that their claims may be incorrect.

The Importance of Choosing a Quality Auditor for Employee Benefit Plans

For years, employee benefit plans (EBPs) have been under a regulatory microscope. Recently, the Department of Labor (DOL) issued a report, Audit Quality Study, November

Remote workforces are complicating state tax nexus and withholding

(authored by RSM US LLP) As businesses increase the use of remote workforces, nexus and withholding determinations can greatly complicate state tax compliance.

IRS Releases 2024 tax inflation adjustments

(authored by RSM US LLP) IRS releases inflation adjustments for 2024. Inflation adjustments impact individual tax brackets and other various provisions of the Code.

IRS expands e-filing with new penalties for more paper forms

(authored by RSM US LLP) Final regulations expand IRS e-filing requirements issued with most changes effective for returns due to be filed in 2024. Filers of more than 10 returns or forms required to e-file in most cases.

Identity crisis: 5 answers to critical identity access management questions

(authored by RSM US LLP) Avoid the pitfalls of IAM. Check out our answers to common questions so you can be prepared to protect your organization.

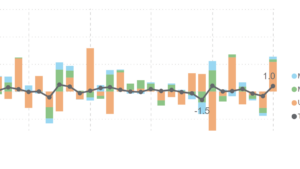

Industrial production and housing rebound in July, affirming GDP growth outlook

(authored by RSM US LLP) Industrial production, housing starts and permits rebounded in July, affirming RSM US LLP’s economic growth outlook for the third quarter.

Tax complexities don’t have to offset the benefits of open-end real estate funds

(authored by RSM US LLP) Explaining the tax complexities associated with open-end real estate funds and how advanced digital applications can handle them.

Strategic procurement can help combat market uncertainty and control costs

(authored by RSM US LLP) Improving procurement processes can help organizations reduce supply chain risks while increasing value and resilience.