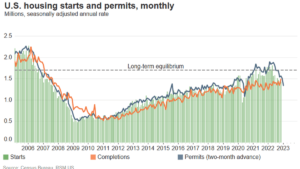

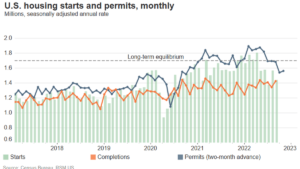

Housing starts and permits fall as the correction continues

(authored by RSM US LLP) New housing starts dropped for the third month in a row in November as the housing market continued to be in correction mode.

IRS issues proposed regulations on syndicated conservation easements

(authored by RSM US LLP) Syndicated Conservation Easement transactions are listed transactions under Treasury’s new Proposed Regulations.

10 smart moves for real estate investors and operators at year’s end

(authored by RSM US LLP) As we close the books on 2022, RSM’s real estate senior analyst Scott Helberg shares 10 important year-end resolutions for real estate investors to consider

U.S. housing starts continue to fall amid rate hikes

(authored by RSM US LLP) New housing starts fell by 8.1% in September as the impact of rising mortgage rates worked through the housing market.

U.S. jobs report: Hiring slows as another 75-basis-point rate increase looms

(authored by RSM US LLP) The U.S. economy is proving far more resilient in the face of sustained pricing pressures than otherwise thought a short time ago.

FASB to propose changes to related party leases guidance

(authored by RSM US LLP) The FASB recently voted to issue proposals on the determination of an arrangement as a lease and the financial reporting requirements for related party lease arrangements for certain entities.

The cost of a data breach: 2022 NetDiligence® Cyber Claims Study

(authored by RSM US LLP) RSM is a proud sponsor of the 2021 NetDiligence® Cyber Claims Study. Download the study to learn the real cost of a data breach.

IRS delays caused employers to wait on needed COVID tax credit relief

(authored by RSM US LLP) Congress passed multiple pieces of legislation aimed at providing relief to employers struggling due to the pandemic. A new Treasury Inspector General for Tax Administration (TIGTA) report finds that ongoing IRS processing delays are causing businesses to wait on COVID-related credits claimed on Forms 941-X. The report states that as of Feb. 1, 2022, there were 447,435 Forms 941-X waiting to be processed.

Given the High Gas Prices, Minimum Wage is Not Even a Working Wage

The average commute in the United States is about 27 minutes. This is about one gallon of gas to and one gallon of gas from

Basic Cyber Hygiene

Cybersecurity has been a chief concern among small business owners for some time, but protecting data from bad actors has become even more important since

What’s In the 2022 Inflation Reduction Act?

On August 16, 2022, President Biden signed into law the Inflation Reduction Act of 2022. This bill, which was initially written as a successor to

90-Day Pre-Exam Compliance Program for Retirement Plans

In June, the IRS began piloting a new compliance program for benefit plan sponsors. This program gives benefit plans 90-days’ notice of an upcoming examination,