FOMC policy decision preview: Fed to hike lending rate .75% next week

(authored by RSM US LLP) A 100-basis-point increase in the federal funds rate will be on the table during the Federal Open Market Committee meeting next week, but we expect the central bank will hike the policy rate by 75 basis points.

Contextualizing cyber risk: Mapping business as a system

(authored by RSM US LLP) Boards need a better understanding of how business could be impacted by cyberthreats.

IRS 90-day pre-examination compliance pilot for retirement plans

(authored by RSM US LLP) The IRS is piloting a pre-examination compliance program for retirement plans, which provides plan sponsors with 90-day window to review plan operations and make corrections prior to examination.

Changes in Fed policy and their impact on the economy

(authored by RSM US LLP) The Federal Reserve’s changes to short-term interest rates will affect the stock of money, which directly determines the direction of the real economy…

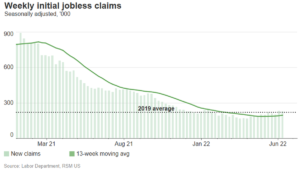

Initial jobless claims exceed pre-pandemic level for second straight week

(authored by RSM US LLP) There were 229,000 new jobless claims for the week ending June 11, down slightly from an upwardly revised 232,000 in the prior week.

Accounting for Leases in 2022

In early 2016, the Financial Accounting Standards Board (FASB) released new guidance on how businesses should account for leases. That new standard went into effect

Ransomware-as-a-service: A new business model for cybercriminals

(authored by RSM US LLP) Ransomware-as-a-Service (RaaS) is a new business model for cybercriminals, making cyberattacks easier than ever.

Ransomware: Protecting your business against evolving risks

(authored by RSM US LLP) Ransomware attacks are increasing and threatening organizations of all sizes. The RSM cybersecurity report reveals new ransomware data.

A Cash Flow Analysis Can Save Your Business

Financial experts claim that 82 – 90% of small business failures are caused by poor cash flow. Many profitable companies find that they are insolvent

The Many Benefits of Outsourcing the CFO Function

As a small to medium-size business owner, you wear many hats and may be responsible for everything from new product development, to operations, human resources,

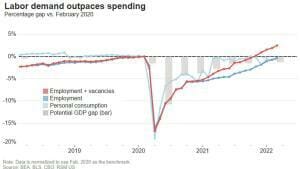

Why excess labor demand is unhealthy

(authored by RSM US LLP) We believe the imbalance in the labor market should prompt companies to reassess their growth potential, and as a result, their demand for labor.