(authored by RSM US LLP) To better manage risks, vendors and service providers should verify the strength of their internal controls, driving demand for the…

The Louisiana Department of Revenue (LDR) issued information for all business that are required to file with the IRS, for the tax year 2022, Forms…

(authored by RSM US LLP) Cyber insurance could be a way to protect health care organizations from costly threats, but there’s much to consider about…

(authored by RSM US LLP) The U.S. economy is proving far more resilient in the face of sustained pricing pressures than otherwise thought a short…

(authored by RSM US LLP) The FASB recently voted to issue proposals on the determination of an arrangement as a lease and the financial reporting…

(authored by RSM US LLP) IRS R&D credit refund claim transition period extended one year.

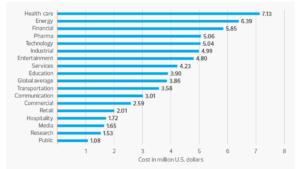

(authored by RSM US LLP) RSM is a proud sponsor of the 2021 NetDiligence® Cyber Claims Study. Download the study to learn the real cost…

(authored by RSM US LLP) Congress passed multiple pieces of legislation aimed at providing relief to employers struggling due to the pandemic. A new Treasury…

The average commute in the United States is about 27 minutes. This is about one gallon of gas to and one gallon of gas from…

Cybersecurity has been a chief concern among small business owners for some time, but protecting data from bad actors has become even more important since…