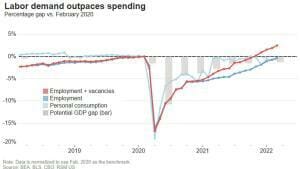

Why excess labor demand is unhealthy

(authored by RSM US LLP) We believe the imbalance in the labor market should prompt companies to reassess their growth potential, and as a result, their demand for labor.

10 steps to reduce the impact of cyberattacks

(authored by RSM US LLP) No organization is immune to suffering a cybersecurity breach. Learn 10 key steps to reduce sophisticated cyberattacks on your business.

Treasury-Backed “Fiscal Recovery Funds” Present Unique Funding Opportunities to State and Local Governments

As part of President Biden’s American Rescue Plan Act (ARPA) that was passed in March 2021, Congress assigned $1.9 trillion in federal funds for “COVID-related

Strategies to help nonprofits address the talent gap

(authored by RSM US LLP) Bridging the nonprofit talent gap requires organizations to find ways to keep their staff members fully engaged.

Discount rate for lessees that are not PBEs

(authored by RSM US LLP) The FASB tentatively decided to allow lessees that are not PBEs to make the risk-free rate election by class of underlying asset.

Louisiana: Road to Recovery (Update 9/14/21)

Our thoughts and prayers are with our clients, friends, employees, and all members of our communities impacted by Hurricane Ida. Our Louisiana offices in Covington,

COVID-19 Impact on Asset Impairment

The coronavirus pandemic infused unprecedented levels of uncertainty into our economy. When the virus became more widely spread in March, businesses closed, workers self-isolated, and

Strategies for streamlining the grant management process

(authored by RSM US LLP) Careful grant management planning can help organizations reduce paperwork, save time, ensure compliance and lead to increased grant awards.

IRS enhances employee retention credit guidance for open questions

(authored by RSM US LLP) Notice 2021-49 provides answers on previously uncertain issues and addresses changes implemented in the American Rescue Plan Act.

Withdrawal of SBA loan necessity questionnaire for PPP loans

(authored by RSM US LLP) The SBA has formally notified PPP lenders that it no longer will require submission of loan necessity questionnaires. Learn more.

SBA formally withdraws loan necessity questionnaire

(authored by RSM US LLP) Small Business Administration, in light of lawsuit, notifies PPP lenders that loan necessity questionnaire is withdrawn.