REAL ECONOMY BLOG | July 22, 2022

Authored by RSM US LLP

A 100-basis-point increase in the federal funds rate will be on the table during the Federal Open Market Committee meeting next week, but we expect the central bank will hike the policy rate by 75 basis points. The fourth boost to the lending rate this year will come amid clear signs of global and domestic economic deceleration that provide policymakers greater degrees of freedom in their campaign to restore price stability.

In our estimation too much has been made in recent days of whether the rate increase will be 75 or 100 basis points. The far more important issue is just how far into restrictive terrain central bankers should lift the policy rate, and at what point they will choose to take the central bank’s foot off the monetary brakes and allow the economy space to further absorb the rate shock the Fed has imposed on the economy to restore price stability.

We think that the July 26-27 policy meeting may provide some hints to answer to those questions.

Lifting the rate to a range between 2.25% and 2.5% from the current 1.50-1.75 in our estimation moves policy into what can be referred to as restrictive terrain consistent with the price stability policy objective, even at the expense of a slower economy. We anticipate that the Fed will continue to lift rates to reach a range between 3.25% and 3.5% before any potential pause to ascertain the direction of growth, inflation and employment.

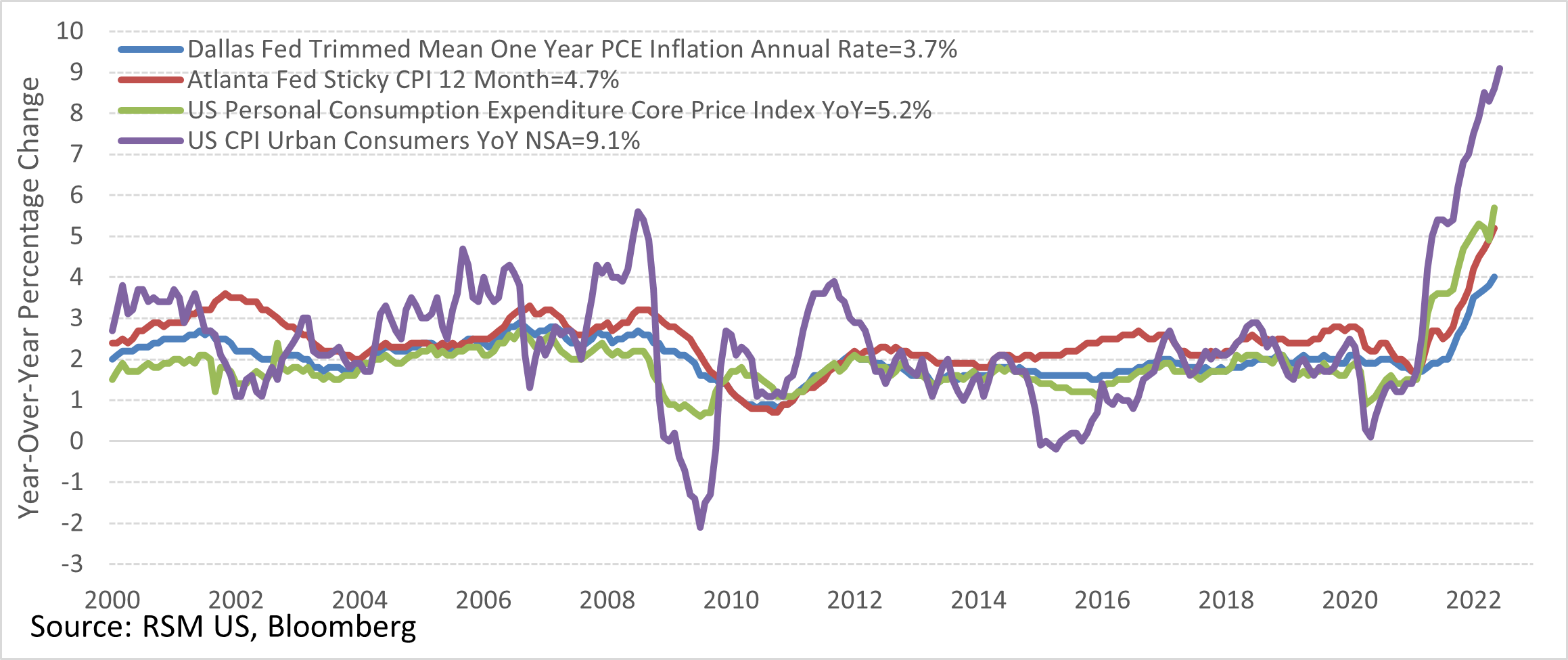

Inflationary pressure

The recent move above 9% inflation and the likely persistence of rising prices inside the housing complex may require the Fed to lift the policy rate to 4% before holding steady next year. This clearly runs the risk of triggering a recession—a policy error in plain sight later this year or early next. While our base case remains that we are caught inside a combined rate and inflation shock that is resulting in a mid-cycle correction, the probability of a recession over the next 12 months stands at an elevated 45%.

The July meeting will not feature a new summary of economic projections nor will it likely see any meaningful changes to the language in the Fed’s statement. Instead, other than the change in the policy rate, the major focus will be on how the Fed chooses to utilize the press conference that follows the statement.

The recent spate of labor market and economic data strongly implies that the economy is decelerating, and we are fairly certain that Fed Chairman Jerome Powell will take the opportunity to accent this slowdown during his press conference.

Doing so would likely result in the following: First, this emphasis would be interpreted as the committee signaling that the probability of further supersized rate increases has declined and market participants should prepare for a slower pace of rate hikes. We expect a 50-basis-point hike at the September meeting and 25-basis-point hikes at the November and December meetings, bringing the Federal Funds policy rate to a range between 3.25% and 3.5% at the end of the year.

Second, Powell will also take the opportunity to reiterate that the Fed will require clear and convincing evidence of a downturn in inflation before the central bank will consider taking its foot off the brakes or effecting any potential pivot on policy even amid a slowing economy.

Finally, it is that slowing economy that will likely result in rising unemployment and a set of credit conditions that will damp corporate earnings going forward that the Fed Chair will implicitly acknowledge as an acceptable price of restoring price stability.

Do you have questions or want to talk?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Joseph Brusuelas and originally appeared on 2022-07-22.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/fomc-policy-decision-preview-fed-to-hike-lending-rate-75-next-week/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

LaPorte is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how LaPorte can assist you, please call 713.548.2034.