LaPorte Directors Bruce Prendergast, Steven Sissac, and Lindy Stonecypher developed an article for New Orleans CityBusiness that provides an overview of the Employee Retention Tax Credit (ERTC) and who might qualify. The article, titled “Have You Claimed the Employee Retention Tax Credit?” can be found in its entirety below.

Have You Claimed the Employee Retention Tax Credit?

By: Bruce Prendergast, CPA; Steven Sissac, CPA; and Lindy Stonecypher, CPA

The Employee Retention Tax Credit (ERTC) was created to incentivize businesses to keep workers employed through the worst parts of the coronavirus pandemic. Although the ERTC expired at the end of September for most businesses (except for recovery startup businesses), it’s not too late to go back and claim the credits. As you’re performing your year-end processes, now is the perfect time to think about how the ERTC can help you.

Before we introduce our checklist of things to think about in 2022, let’s take a quick second to remind ourselves what the ERTC is and how it works.

Overview of the ERTC

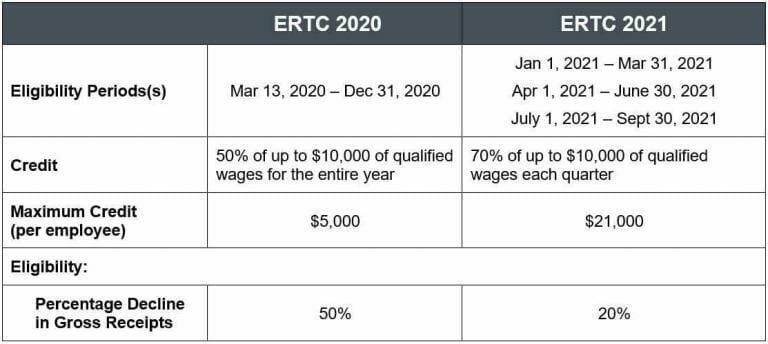

The ERTC is a refundable payroll tax credit that can be claimed for eligible wages paid from Mar. 13, 2020, through Sept. 30, 2021.

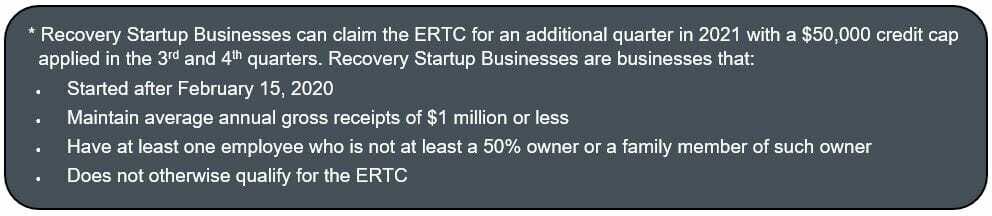

Employers who qualify can claim a 50% credit of up to $10,000 of qualified wages paid to each employee between Mar. 13 and Dec. 31, 2020 (making the maximum credit $5,000 per employee in 2020). In the first three quarters of 2021, eligible employers can claim a 70% credit of up to $10,000 of qualified wages per employee per quarter (making the maximum credit $21,000 per employee in 2021*). Qualified health plan expenses may be considered as qualified wages for the ERTC calculation.

The ERTC can only be claimed by businesses that meet both the following two criteria:

- They can prove their business operations were suspended due to a government order. See below for additional information related to requirements to prove a suspension by government order.

- or they can show they had a decline in gross receipts.

For the 2020 ERTC gross receipts test, you must prove that your gross receipts were at least 50% less than what they were in the corresponding calendar quarter from 2019.

For the 2021 ERTC gross receipts test, you must prove that your gross receipts were at least 20% less than what they were in either (a) the corresponding calendar quarter from 2019, or (b) the immediately preceding calendar quarter.

The credit is based on the employer’s average full-time equivalent (FTE) for 2019.

- For the 2020 ERTC, you must show that in 2019 you had 100 or fewer average FTEs.

- For the 2021 ERTC, you must show that in 2019 you had 500 or fewer average FTEs.

A limited credit is available for those employers exceeding these limits on FTEs, but it is only for wages paid to employees who did not work. Regular sick and vacation time does not qualify.

Below is a table that can help you see the differences between the 2020 and the 2021 credits. Note: this table does not apply to Recovery Startup Businesses.

Even though the ERTC expired at the end of September 2021, you can still claim the credit in prior eligible calendar quarters by amending your quarterly payroll tax forms using Form 941-X. You have three years to file an amended payroll tax return, but it’s wise to do this in 2022, before filing your 2021 income tax return.

If you’re considering claiming the ERTC on an amended payroll tax return, here are a few things you should be thinking about.

You may be eligible for the credit and not realize it.

The changes made between the 2020 and 2021 credit iterations ensure that even more businesses are eligible. If your team determined you were ineligible for the ERTC in 2020, look at the rules again; you may very well be able to claim the credit in 2021.

You can claim the credit even if you took out a PPP loan.

When the ERTC was first introduced with the CARES Act in Mar. 2020, those who took out a Paycheck Protection Program (PPP) loan were not eligible for the ERTC. However, Congress retroactively changed this rule. Today, you can receive (and be forgiven for) a PPP loan without jeopardizing your tax credit. The only catch is that you can’t use the same wages to qualify for PPP loan forgiveness that you use to calculate your credit.

Before you apply for PPP loan forgiveness, talk to your CPA; they can help you fill out the paperwork to maximize your benefits from both programs.

PPP loans don’t count as gross receipts for the revenue calculation.

When determining if your business had a 50% decline in gross receipts (for the 2020 credit) or a 20% decline in gross receipts (for the 2021 credit), you can disregard PPP loan proceeds.

The IRS gives itself 5 years to audit the ERTC.

The statute of limitations is typically only three years, but the IRS gave itself five years to audit use of the ERTC. This five-year countdown begins when you file your payroll tax return, and if you amend a return, the clock restarts. Extending the statute of limitations may signify the IRS plans to focus more heavily on ERTC compliance in the coming years. You can be prepared by having all paperwork necessary to support your claim. You will want to collect the following:

- Documents that show that you were an eligible employer.

Your employee timesheets and paystubs from 2019 should show that you had less than 100 FTE (for the 2020 credit) or less than 500 FTE (for the 2021 credit) on average. - Documents that show how you calculated qualified wages.

This breakout should show which employees received the wages and in what amounts. Remember that health plan expenses are considered qualified wages for purposes of the ERTC. - Documents that show how a government order affected your business operations (if applicable).

- Documents that show you had a decline in gross receipts (if applicable).

Your gross receipts calculation should be done on the tax basis. This means the gross receipts shown on your financial statements may differ from what you report for the ERTC calculation. If you’re not sure how these two amounts differ, get in contact with a professional who is well versed in the ERTC and tax law so they can help. - Documents that show whether you are a member of an aggregated group.

Continue reading to learn how affiliated businesses are aggregated for the purpose of determining ERTC eligibility. - Copies of all payroll tax forms.

This includes quarterly returns (Form 941) and the form used to claim advance payment of the ERTC (Form 7200).

The gross receipts calculation is easier (and less risky).

The gross receipts calculation – when done correctly – is black and white. Your team can show without a shadow of a doubt that your gross receipts fell. Qualifying for the ERTC using the other method – by stating your business operations were suspended due to a government order – is a bit trickier to prove. You’ll have to ask yourself:

- How were your operations suspended?

- How can you prove your operations were suspended?

- How can you show your change in operations was directly related to a government order?

For example, restaurants who typically operate at capacity may be able to prove their operations were affected if they had to turn customers away due to capacity restrictions. A retail space that does not track live customer counts would have a more difficult time arguing that the government order affected their business. If you choose to prove your eligibility with this method, make sure you supporting documentation to back up your claims.

Be careful if you have affiliated businesses.

If your business is a member of a controlled group, all businesses within the controlled group may be treated as one entity when determining ERTC eligibility. Controlled groups can have either parent-subsidiary relationships or brother-sister relationships.

- In a parent-subsidiary relationship, a common parent entity owns directly or indirectly 50% or more of the voting power of the subsidiary.

- In one of the most common brother-sister relationships, five or fewer non-corporate taxpayers own 50% or more of the voting power of all entities.

If your business is part of a controlled group, you’ll need to aggregate your data with other members of the group for purposes of the ERTC employee count test, the gross receipts test, and the operation disruption test. This may make it more difficult for you to qualify for the credit.

You must also aggregate members of an affiliated service group. This is fairly complicated to define and is best left to a tax professional.

Don’t trust just anyone who claims they can help you with the credit.

Since the ERTC and the PPP loans were introduced, more and more vendors came on the market to help businesses like yours apply for these types of incentive programs. Be careful whom you work with. Not all companies are created equal. Make sure you select a company that keeps up with the ERTC changes (there have been many!), and if you’re not sure, talk to your CPA.

If you qualify, the ERTC is a fantastic opportunity to save taxes. Talk to a trusted advisor to see if the ERTC can help your business.

Bruce Prendergast, Lindy Stonecypher, and Steven Sissac are directors at LaPorte and are key members of LaPorte’s Covid 19 relief task force, formed to help clients navigate relief funds and credits.