The war in Ukraine has already had a profound impact on the availability and pricing of commodities. Since Russia invaded Ukraine in February, we have seen the price of oil skyrocket. Many assume that the high prices have been a boon to oil and gas companies, but this couldn’t be further from the truth. While the energy sector has certainly seen gains in the short term, their long-term outlook is shrouded in uncertainty thanks to lingering effects of the coronavirus pandemic.

What Has Been Happening to Oil Prices?

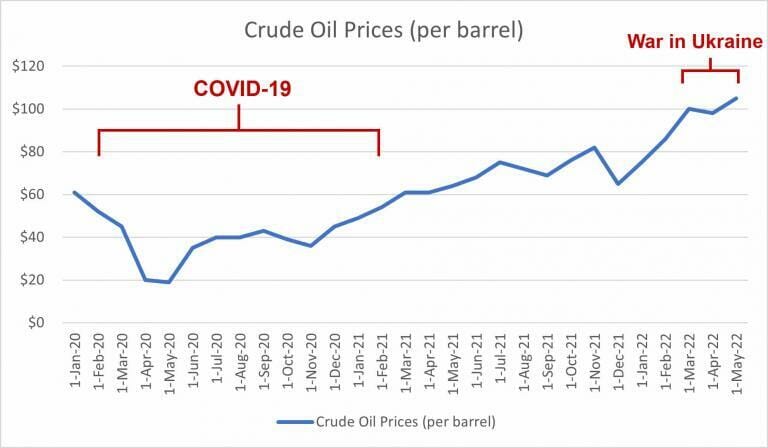

In the past 2 ½ years, we have seen the price of crude oil drop to some of its lowest lows and soar to some of its highest highs. At the beginning of 2020, when COVID-19 first surfaced overseas, oil prices began dropping. They went from $60 per barrel in January down to $20 in April, even briefly dropping below zero. The prices began to recover, but slowly; it took until April 2021 to recoup prices to that $60 pre-COVID benchmark.

In the past 12 months, the price of crude oil has oscillated between $65 and $85 per barrel up until Russia launched its military invasion on Ukraine. On March 8, 2022, just a couple weeks after the war began, oil prices spiked to $120 per barrel, and they’ve been sitting at around $105 ever since.

Will these high prices last? We cannot predict the outcome of the Ukraine war, nor can we conjecture how future events will affect global commodities pricing. But even with sustained high prices, oil and gas companies may still struggle to make ends meet because many are still battling the after-effects of the coronavirus pandemic.

How Is the Pandemic Affecting Oil and Gas Companies in 2022?

We recently sat down with an industry expert to chat about what’s really going on behind the scenes in the energy sector.

Ryan Kelley, CPA, LaPorte Director in Audit and Assurance Services, recently spoke with Kris Schaumburg, CPA, about what recent global events might mean for local oil and gas companies. Kris, who is a former President of the Council of Petroleum Accountants Societies (COPAS) New Orleans (and a LaPorte alum), iterated how the recent oil prices haven’t been enough to save independent producers from their downward spiral.

During most of 2020, when oil prices were at or below break-even point for most operators, small and independent oil and gas companies struggled. Some closed, selling their equipment to larger operators that had the capital to survive; others consolidated with joint interest partners to lower operating costs.

Unfortunately, these weren’t perfect solutions. Kris explained that many companies that exited the industry are now, months or years later, being pulled back in. While not universal, many oil and gas producers remain on the hook for abandonment costs even after they’ve left the industry. If the company that purchased their assets files for Chapter 11, prior owners can be named in bankruptcy proceedings and be responsible for at least some of the costs to decommission or restore an orphaned oilfield site.

Fortunately, Louisiana gives oil producers an opportunity to protect against abandonment liabilities. If a company establishes a Site Specific Trust Account (SSTA) after they transfer 100% of their property rights to another operator, the state absolves the company of future abandonment liability and the SSTA can be used to fund restoration costs.

What Other Struggles Are Oil and Gas Companies Facing?

Abandonment obligations are only one piece of the puzzle. The COVID-19 pandemic and the Ukraine crisis have also contributed to:

High Inflation

Oil and gas companies are feeling inflation most acutely in their food costs. A larger portion of operating costs are now being spent on simply feeding oilfield workers, and high barrel prices may not be enough to compensate for those new costs.

High Labor Costs

The ability to retain good and qualified workers on high-risk oilfields has always been difficult, but the labor shortage that began with the COVID-19 pandemic hasn’t let up. And it’s not only oilfield workers that are hard to find; it has also been difficult to meet freight requirements when the trucking industry is also struggling to find qualified workers.

Supply Chain Concerns

The global steel market is being hit hard by supply chain disruptions, making it difficult for oil and gas companies to meet the high demand that’s required to capitalize on the new (and almost certainly short-lived) price hike.

The coronavirus pandemic sent the global economy into a tailspin, and the current high oil prices may not be enough to help independent producers recover.

Visit our website to read more articles of interest or to learn more about LaPorte’s Energy Industry Group.