REAL ECONOMY BLOG | May 11, 2023

Authored by RSM US LLP

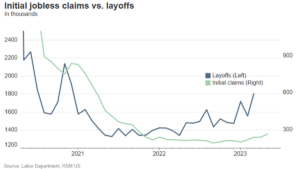

Initial jobless claims rose by 9.1% for the week ending May 6, to 264,000, the most since 2021, the Labor Department reported on Thursday. The rise came as the Labor Department also reported the producer prices bounced back in April, in part because of favorable comparisons to surging prices of a year ago.

The sharp jump in new claims broke the short-term trend of claims moving sideways since March, bringing new filings for jobless benefits one step closer to our threshold of 350,000 when the labor market shows distress.

The unexpected change was also driven by another surge in new claims from Massachusetts, which posted an increase of more than 6,000 on a non-seasonally adjusted basis to about 35,000 last week. Four weeks ago, Massachusetts’ initial claims stood at 15,900.

If our prediction for a recession in the second half of the year turns out to be true, we should expect new claims to rise further and faster in the next three to four months, while at the same time job gains slow.

Continuing claims also inched up to 1.813 million for the week ending April 29, continuing its upward trend since last September, when it reached the bottom of 1.3 million.

Producer inflation

In a separate report from the Labor Department on Thursday, prices for final demand received by producers bounced back in April, rising by 0.2% on the month after falling by a sharp 0.4% in March. The report is another sign for the Federal Reserve that the path to get inflation under control will continue to be bumpy.

Despite April’s rebound, the year-over-year producer inflation rate fell to 2.3% from 2.7% because of base effects, or comparisons to last’s year spike in prices during the start of the Ukraine war.

But the core inflation figure, which excludes food and energy, stayed sticky, easing to 3.2% from 3.4% on a year-ago basis. Monthly core inflation rose by 0.2%.

Besides the base effects, the sticky core producer inflation rate that is hovering in the 3% to 4% range is aligned with our forecast that the overall underlying inflation rate should remain above 3% by year’s end, keeping the Fed off rate cut consideration this year.

Beyond the top-line number, trade services—a proxy for wholesale and retail margins—rebounded by 0.5% on the month after dropping by 0.4% in March.

Still, as the economy continues to move toward the end of the business cycle, margins have been one of the most vulnerable components. Only about a year ago, trade services rose by at least 1% for multiple months, once even reaching 2%.

Do you have questions or want to talk to a LaPorte professional?

Fill out the form below and we’ll contact you to discuss your situation.

This article was written by Tuan Nguyen and originally appeared on 2023-05-11.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/jobless-claims-and-producer-inflation-show-mixed-results/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

LaPorte CPAs & Business Advisors is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how LaPorte CPAs & Business Advisors can assist you, please call 713.548.2034.