The Tax Cuts and Jobs Act (TCJA) changed tax planning for many business owners in the construction industry. TCJA allowed many contractors to utilize methods that were previously only available to smaller construction businesses. Though this won’t be the right move for all businesses, contractors who haven’t yet considered changing their accounting method should talk to their advisors and see how — and to what extent — it could affect their tax outlook.

What changed with the TCJA?

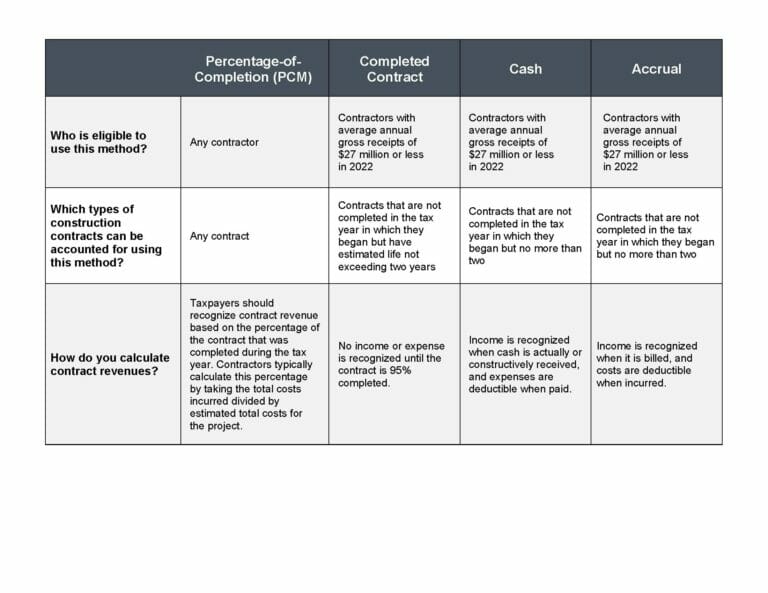

Under TCJA, the threshold for using the cash method of accounting and the completed contract method of accounting for long-term projects significantly changed, allowing more contractors flexibility.

Here’s what changed:

Cash vs. Accrual

Prior to 2018, businesses were only able to use the cash method of accounting if their average annual gross receipts for the past three years were $10 million or less. The threshold was raised to $25 million, adjusted for inflation annually. The threshold is now at $27 million for 2022, and will be $29 million for 2023.

Accounting for Long-Term Contracts

Before the TCJA, construction companies with average annual gross receipts of more than $10 million were required to use the percentage-of-completion method (PCM) when calculating the tax impact of long-term projects. A project is considered long-term if it is spans two tax years, and the entire project is expected to be completed within two years from inception. Beginning in 2018, this threshold also rose to $25 million and is now $27 million in 2022. This means that today, contractors with gross receipts under this threshold can choose how they are taxed on long-term projects. They may continue using the PCM, or they can use completed-contract method, the cash method, or the accrual method.

Which contractors are required to use the percentage-of-completion method?

In general, contractors are required to use the PCM when reporting long-term contracts on their tax return unless they or their project meets one of the following exceptions:

Their build is a home construction or residential contract.

Home construction contracts are contracts where 80% of the costs are attributed to building single-family homes or multi-family homes with no more than four dwelling units to a building. They also include contracts to improve real property associated with one of these types of homes. Residential construction includes the building of homes with more than four dwelling units like apartments, dorms, and nursing homes, but does not include transient residential units like hotels or hostels.

They perform exempt activities.

Industrial and commercial painters, engineers, architects, and construction management businesses are not required to use the PCM.

They have average annual gross receipts of $27 million or less.

For 2022, taxpayers with three-year average annual gross receipts of $27 million or less are not required to use the PCM when accounting for long-term contracts that are estimated to last up to two years.

How is the percentage-of-completion method calculated?

The percentage-of-completion method recognizes revenues over the life of the contract. To calculate the PCM, estimated revenue is multiplied by the estimated percentage of completion, and the taxpayer recognizes the portion of revenue the taxpayer has not recognized in the past. The percentage of completion is determined by the costs incurred divided by the total estimated costs. Additionally, if the percent completed in a year is 10% or less, taxpayers may be able to defer income recognition until the next year if they also made a 10% deferral election.

Revenue recognition under the PCM is similar to the method under ASC 606, as required for Generally Accepted Accounting Principles (GAAP), with one significant difference: how losses are reported. For GAAP purposes, contractors should recognize a loss immediately if they estimate that their contract expenses are likely to exceed their contract revenue. For tax purposes, taxpayers cannot accelerate their losses and must defer the loss recognition until the contract is complete.

How is the completed contract method calculated?

Contractors who report long-term contract revenue under the completed contract method won’t recognize contract revenues or expenses until the year the contract is at least 95% complete.

Which accounting method should contractors use?

If contractors’ gross receipts are below the $27 million threshold, they have the option to use the completed contract method of accounting rather than the PCM. But does that mean they should?

In most cases, contractors prefer the completed contract method because it lets them defer taxable income for longer, but there are a few downsides to switching from PCM to completed contract method.

Access to Working Capital and Cash Flow

When taxpayers use the completed contract method, the tax burden of a project generally falls into only one tax year. This could pose a problem for businesses struggling with cash flow. If a business has multiple projects that are completed within the same year, or if their taxes come due in the same year that working capital is earmarked for another project, the company’s working capital may be at capacity.

Administrative Burden

The completed contract method is for tax reporting purposes only, which means that businesses must keep two sets of books: one for the IRS and one in compliance with GAAP for financial reporting purposes.

Alternative Minimum Tax (AMT)

Because the PCM is the method that must be used for alternative minimum tax calculations, businesses subject to the AMT may not see a tax benefit from switching to the completed contract method. However, some contractors may be exempt from the AMT.

If neither the completed contract method nor the PCM are good fits, contractors whose revenues fall below the $27 million threshold can also use the cash method or the accrual method. Although the accrual method of accounting more closely aligns with GAAP, some contractors prefer the cash method because the recognition of income and expenses aligns with cash flow.

Accounting method decisions are multi factorial, so businesses should discuss these options with their CPAs.

What do these changes mean for contractors?

With the TCJA, contractors were given the gift of choice.

By raising thresholds to $25 million ($27 million in 2022), the TCJA allowed more construction businesses to use the cash method of accounting and the completed contract method for long-term contracts if they so choose. These options may create tax deferral opportunities for construction contractors. Deferring tax payments may help the business’s cash flow position.

If your construction business hasn’t reviewed its overall method of accounting and long-term contract methods, contact a tax leader in LaPorte’s Construction Industry Group. We can help you determine if adopting one of these available methods would be a good move for your company.