Forbes has named LaPorte to the list of “America’s Top Recommended Tax and Accounting Firms” for 2020. The global media company partnered with Statista, a…

On January 1, 2020, approximately 1.2 million more U.S. workers will become eligible for overtime pay. The Department of Labor (DOL) increased the salary threshold…

The IRS is informing more and more employers that they are facing Affordable Care Act penalties for failing to meet the employer mandate. Planning and…

Although the Tax Cuts and Jobs Act (TCJA) was written into law more than a year ago, it continues to play a strong role in…

The Financial Accounting Standards Board (FASB) has made a significant change to accounting standards related to accounting for financial instruments. Accounting Standards Update 2016-01 (ASU…

While the beginning of the month can signify a fresh start for some, small businesses and their accounting departments sometimes associate the first few days…

As a small business owner, you’ve almost certainly heard the phrase, “your financial statements say a lot about your organization.” But the truth is,…

It sounds like this would be a simple question to answer – but is it? Determining your new worker’s employment status may be trickier than…

In today’s fast-paced environment, we thrive on efficiency — of resources, time, and energy. One of the easiest ways for a growing business to streamline…

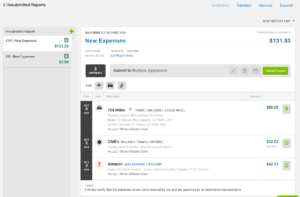

The 2017 Tax Cuts and Jobs Act (TCJA) made several changes to the tax deductibility of meal and entertainment (M&E) expenses. In an effort to…