(authored by RSM US LLP) For common control leases, the FASB is drafting amendments to simplify determining whether a lease exists, the classification of the…

(authored by RSM US LLP) Proposed improvements to leases guidance on related party arrangements The Financial Accounting Standards Board (FASB) has issued a proposed Accounting…

(authored by RSM US LLP) The FASB recently voted to issue proposals on the determination of an arrangement as a lease and the financial reporting…

(authored by RSM US LLP) A guide to lessee accounting under ASC 842 has been updated to incorporate guidance from the ASUs issued by the…

In early 2016, the Financial Accounting Standards Board (FASB) released new guidance on how businesses should account for leases. That new standard went into effect…

Eight Tips for Shoring Up Your Defenses Most U.S. organizations process important information every single day, every single hour, every single minute. When that information…

(authored by RSM US LLP) A proposed FASB ASU would require a buyer that uses a supplier finance program to disclose certain information about the…

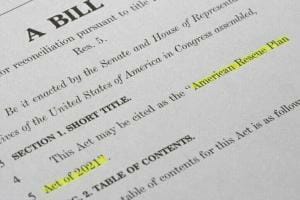

As part of President Biden’s American Rescue Plan Act (ARPA) that was passed in March 2021, Congress assigned $1.9 trillion in federal funds for “COVID-related…

The coronavirus pandemic infused unprecedented levels of uncertainty into our economy. When the virus became more widely spread in March, businesses closed, workers self-isolated, and…

(authored by RSM US LLP) We have updated two of our white papers to reflect an update in the SBA’s PPP loan FAQ for borrowers…